New customer Special Offer

1 oz $50 Gold American Eagles at Cost

THIS INTRODUCTORY OFFER IS AVAILABLE TO FIRST-TIME CUSTOMERS ONLY!

Due to extremely limited suppy, orders will be limited

to one per household, per lifetime.

Call for this Nationwide Exclusive

1.855.203.7076

We understand the importance of having a diverse and comprehensive financial portfolio. A well-crafted portfolio should maintain great profit potential during the good years yet still protect your bottom line when the inevitable economic storm hits. It should also suit your needs. A portfolio that allows you to retire comfortably will look very different from a short-term savings plan. Our account executives are experts at crafting tailor-made precious-metals portfolios.

Curated Selections

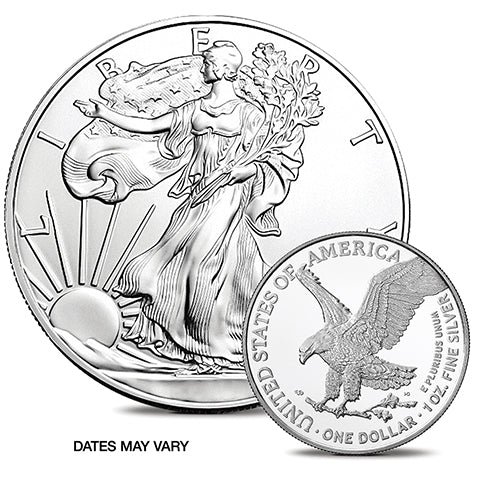

Spotlight Products

Education Center

Gold & Precious Metals

Yellow Gold Watches in Style for the Wealthy

Yellow gold is back in style for high-end luxury watches. New watch models from TAG Heuer, Vacheron Constantin, Hublot, and Cartier...

Gold Miner Polymetal to Pull Out of Russia

One of the world’s leading gold and silver miners is splitting itself apart as a result of U.S. sanctions against Russian...

The World’s Deepest Gold Mine Lives On

South Africa-based Harmony Gold Mining Company plans to extend the life of the world’s deepest gold mine by investing $410 million...

Testimonials

See what people are saying about Nationwide Coin & Bullion Reserve